Do you have any knowledge of "Pension Indexing For Employed Pensioners: A Comprehensive Guide" ?

Editor's Notes: "Pension Indexing For Employed Pensioners: A Comprehensive Guide" have published today, on [2023-07-19]. The topic of pension indexing is important for employed pensioners to understand, as it can have a significant impact on the value of their pension benefits over time. This guide will provide an overview of pension indexing, including how it works, the different types of indexing, and the factors that can affect the rate of indexing.

We made Pension Indexing For Employed Pensioners: A Comprehensive Guide guide to help you make the right decision. We've analyzed and summarized information, and put together this guide to make it easier for you to understand.

Key differences or Key takeways

| Pension Indexing For Employed Pensioners: A Comprehensive Guide | What is Pension Indexing For Employed Pensioners: A Comprehensive Guide? |

| Definition | Pension indexing is a mechanism that adjusts the value of pension benefits over time to keep pace with inflation. |

| Purpose | The purpose of pension indexing is to ensure that the purchasing power of pension benefits does not erode over time due to inflation. |

| Types | There are two main types of pension indexing: price indexing and wage indexing. |

| Factors affecting indexing rate | The rate of pension indexing is typically determined by the rate of inflation or wage growth. |

Transition to main article topics

FAQ

This section aims to answer frequently asked questions regarding the pension indexing system for employed pensioners. Pension indexing is a crucial mechanism that ensures the preservation of purchasing power of retirement benefits in the face of inflation.

Mobile-First Indexing: A Comprehensive Guide - Source www.dealersleague.com

Question 1: What is pension indexing?

Pension indexing refers to the annual adjustment of pension payments to keep pace with the rising cost of living. It is a mechanism designed to protect the value of retirement benefits over time.

Question 2: How is the pension index calculated?

The pension index is typically calculated based on changes in a specific consumer price index (CPI) or a combination of economic indicators. The CPI measures the average change in prices for a basket of goods and services commonly purchased by households.

Question 3: What is the purpose of pension indexing?

Pension indexing serves two primary purposes: 1) To prevent the erosion of purchasing power of pension benefits due to inflation. 2) To maintain the standard of living for retired individuals by ensuring their retirement income keeps up with the rising cost of living.

Question 4: Does pension indexing apply to all pensioners?

Pension indexing policies may vary depending on the country or pension plan. In some cases, pension indexing may be applicable to all pensioners, while in others, it may be limited to certain groups or those who meet specific eligibility criteria.

Question 5: How often is pension indexing applied?

The frequency of pension indexing also varies. Some plans may adjust pensions annually, while others may do so every few years or when the CPI reaches a certain threshold.

Question 6: What are the potential limitations of pension indexing?

While pension indexing can provide important protection against inflation, it may also have limitations, such as the potential for indexation rates to lag behind actual inflation, leading to a gradual erosion of purchasing power over time.

Understanding the intricacies of pension indexing is crucial for employed pensioners seeking to safeguard the purchasing power of their retirement benefits. For more comprehensive information, explore the article Pension Indexing For Employed Pensioners: A Comprehensive Guide.

This FAQ section provides a foundation for addressing common concerns and misconceptions surrounding pension indexing. By staying informed, pensioners can make informed decisions regarding their retirement planning.

Tips

Pension indexing is a critical factor for employed pensioners to ensure their retirement income keeps pace with inflation. Here are several tips to consider for effective pension indexing:

Tip 1: Understand the Indexing Mechanism

Familiarize yourself with the specific indexing formula and frequency used by your pension plan. Different plans may use different indices and apply adjustments at varying intervals.

Tip 2: Monitor Inflation Regularly

Stay informed about inflation rates and economic trends that may impact your pension value. Official inflation statistics, such as the Consumer Price Index, can provide insights into how quickly the cost of living is rising.

Tip 3: Consider Cost-of-Living Adjustments (COLAs)

Explore pension plans that offer COLAs, which typically adjust pension payments annually based on the change in a specified cost-of-living index. COLAs help protect against the erosion of purchasing power over time.

Tip 4: Calculate the Real Return

Factor in the indexing rate when calculating the real return on your pension investment. The real return represents the actual increase in purchasing power, taking into account inflation and any indexing adjustments.

Tip 5: Seek Professional Advice

If you have concerns or questions about pension indexing, consider consulting with a financial advisor or pension expert. They can provide personalized guidance based on your specific circumstances and retirement goals.

Summary

Effective pension indexing is essential for maintaining the value of retirement income. By understanding the indexing mechanism, monitoring inflation, considering COLAs, calculating the real return, and seeking professional advice, employed pensioners can ensure their pension keeps pace with the rising cost of living and provides a secure financial future.

Pension Indexing For Employed Pensioners: A Comprehensive Guide

Pension indexing, a common practice in pension plans, adjusts pension benefits periodically to maintain their purchasing power in the face of inflation. For employed pensioners, pension indexing plays a critical role in preserving the value of their retirement income, especially in an environment of rising prices. This guide explores the essential aspects of pension indexing for employed pensioners, providing a comprehensive overview of its implications and nuances.

- Automatic Adjustments: Indexing occurs automatically, adjusting benefits based on inflation indices, typically the Consumer Price Index (CPI).

Pension Indexing Rate for 2024 - Source www.evansretirement.ca - Benefit Protection: Indexing shields pension benefits from erosion due to inflation, safeguarding the retiree's standard of living.

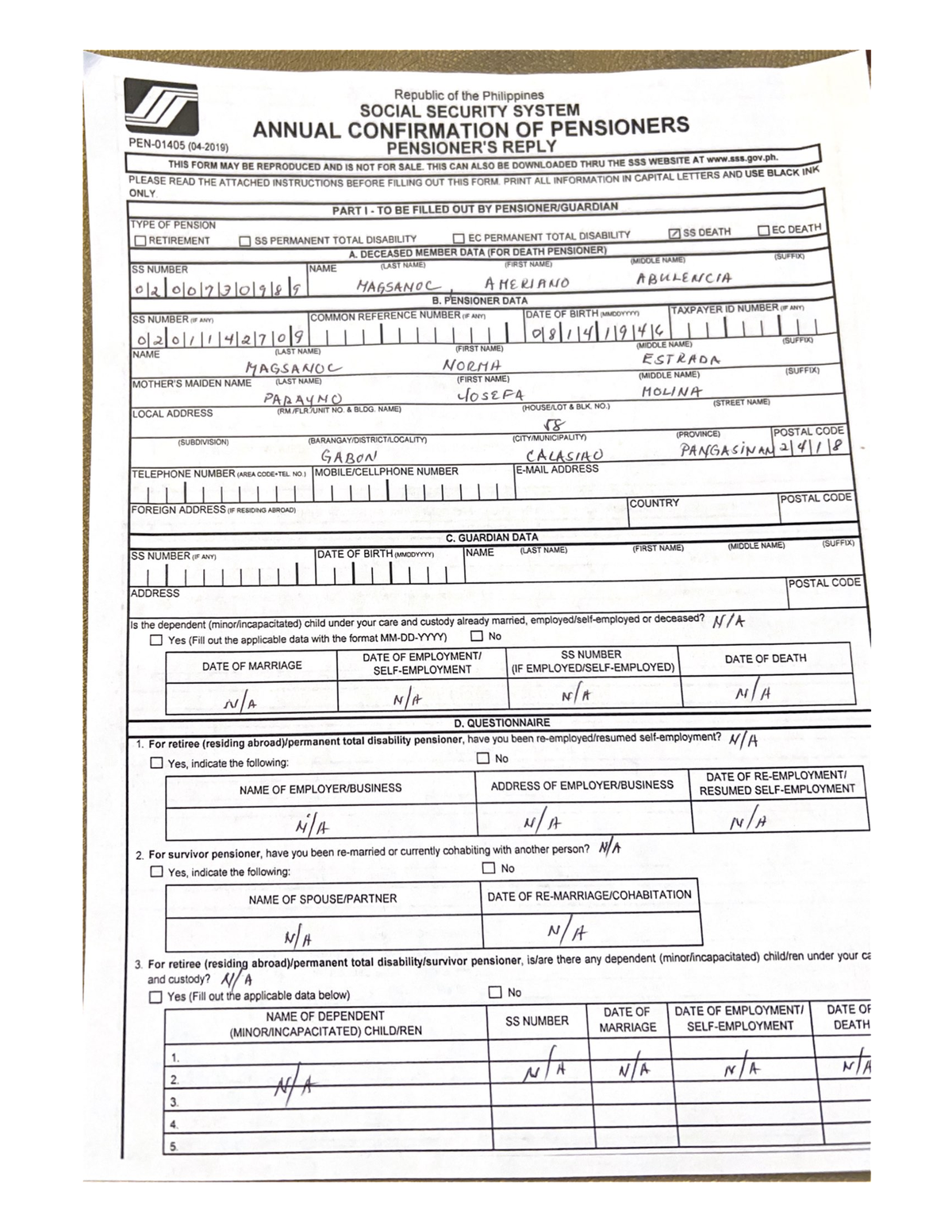

Annual Confirmation OF Pensioners - Accountancy - Studocu - Source www.studocu.com - Long-Term Sustainability: By linking benefits to inflation, indexing ensures the long-term sustainability of pension plans, mitigating the impact of rising costs.

Solo 401(k): A Comprehensive Guide for Self-Employed | PD - Source www.pensiondeductions.com - Employer Contributions: Indexing may influence employer contributions, as they need to cover the additional costs associated with benefit adjustments.

தமிழ்நாடு தொடக்கப்பள்ளி ஆசிரியர் மன்றம்-நாமக்கல்: G.O Ms.No. 98 Dt - Source mandramnkl.blogspot.com - Equity Considerations: Indexing promotes fairness by adjusting benefits equally for all pensioners, regardless of their employment status.

.png)

Personal Pension for Self-Employed: A Comprehensive Guide - Source www.finanz2go.com - Financial Planning: Pensioners rely on indexing to plan their retirement expenses, as it provides a predictable and stable income stream.

16th Actuarial Review - NIS - Source www.nis.gov.bb

In conclusion, pension indexing for employed pensioners is a multifaceted aspect of retirement planning that involves automatic benefit adjustments, protection against inflation, and long-term sustainability. Understanding its implications and nuances is crucial for both pensioners and employers, as it directly affects the financial security and stability of retirees. By ensuring the preservation of purchasing power, indexing safeguards the value of pension benefits, enabling pensioners to maintain their standard of living throughout their retirement years.

Pension Indexing For Employed Pensioners: A Comprehensive Guide

Pension indexing is a crucial component of retirement planning for employed pensioners. It ensures that the value of their pension payments keeps pace with inflation, preserving their purchasing power over time. Without indexing, inflation would erode the real value of pensions, making them less effective in providing financial security in retirement.

Find A Right Pension Lawyer | Legal services, Legal advice, Pensions - Source in.pinterest.com

The importance of pension indexing is evident in real-life examples. In countries where pensions are not indexed, pensioners often face significant financial hardship as their incomes fail to keep up with rising costs of living. Conversely, in countries with well-established pension indexing systems, pensioners are better able to maintain their standard of living throughout retirement.

Understanding the connection between pension indexing and the well-being of employed pensioners is essential for policymakers, retirement planners, and individuals saving for retirement. It highlights the need for robust indexing mechanisms to safeguard the financial security of pensioners and ensure they can live with dignity in their golden years.

Posting Komentar